- Saudi Arabia’s Public Investment Fund (PIF) will invest $319 million in the country’s coffee industry

- This is part of a broader strategy where Saudi is opening itself up to international business and trade

- Despite current “negligible” volumes in coffee production, the question is whether or not these substantial investments will help Saudi compete on the global market

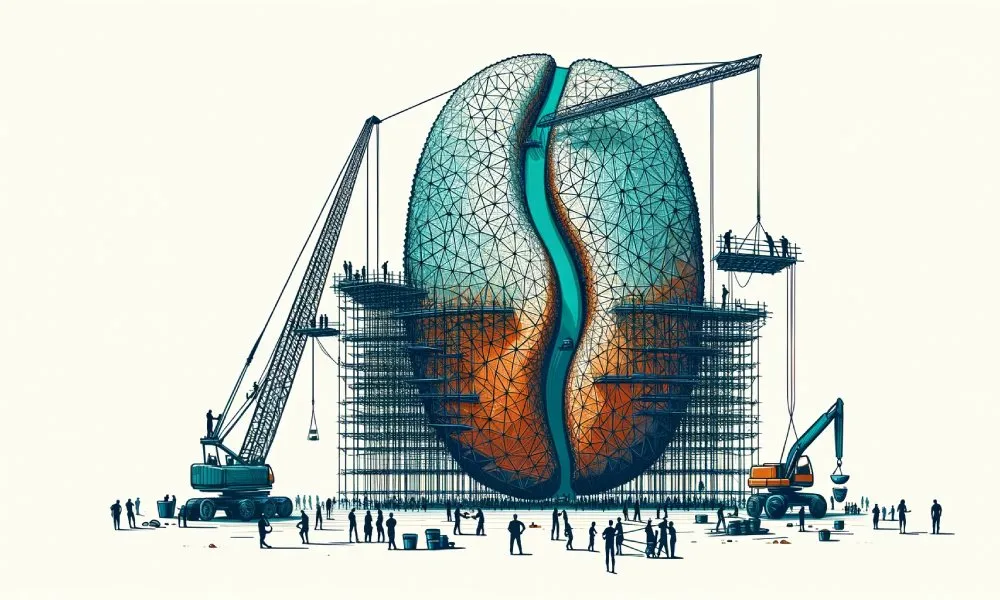

IN RECENT years, there has been an acknowledgement in Saudi Arabia that the fossil fuel age is coming to an end. The country knows that economic diversification is critical – not just for the prosperity of its population, but also for its standing on the global stage.

In this effort, the government has been focusing investments in agriculture, including their historic and much-loved coffee industry.

Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), launched Saudi Coffee Company in May 2022 – which is investing $319 million over the next ten years to support the growth of the national coffee industry – from production to consumption.

The government is especially focused on developing arabica coffee production in the southern Jazan region, aiming to boost annual yields from 800 to 2,500 tonnes. Coffee from Saudi Arabia shares similar attributes with the highly-regarded Yemeni coffee, which is located on the other side of the border.

Ibrahim Saad, co-owner at Torch Coffee Labs and trainer at the Sustainable Coffee Institute says investments will help to plant 1.3 million trees across the country by 2025. Once the trees start bearing fruit, this would quadruple national production with an estimated 40,000 bags by 2028.

To offer more comprehensive support, the government is offering technical and financial assistance to farmers and forming partnerships with international organisations. For example, Saudi Arabia recently became a partner of the International Coffee Agreement, and will also provide technical support to farmers across the country in collaboration with IFAD.

Building a national coffee ecosystem

Saudi Arabia has a rich coffee-drinking tradition that continues today. Over the last eight years, there has also been a growing popularity for specialty coffee, and a consuming culture is developing that resembles that in Europe and the US.

In 2022 alone, Saudi Arabia’s branded coffee shop market grew by 18.5% to reach 3,550 outlets. This accounts for a substantial 40% share of the entire Middle East’s 8,800-plus branded coffee shops.

Saudi Arabia has five of the Middle East’s top 20 coffee chains. Local coffee company Barns operates over 500 stores – the second-largest chain after Dunkin’ Donuts. Major international brands like Starbucks, Costa Coffee, Tim Hortons, and others are expanding their outlets in response to strong demand.

And Saudi Coffee Company aims to capitalise on this. Beyond coffee production, they will allocate funds towards importing businesses, roasting operations, coffee shops, and barista training academies across the country as part of a holistic supply chain investment.

“Before, most coffee shops here were importing roasted coffee from Europe or the US, but when specialty kicked off 8 years ago, it was the ignition,” says Ibrahim. “Specialty coffee shops started roasting their own coffee and by 2019, everyone started opening roasteries. Now, more than 90% of Saudi coffee shops are sourcing roasted coffee from local roasters.”

To round off these investments, the government aims to boost production to the point where Saudi Arabia can compete on the global market, as well as meet this increased internal demand and build a strong domestic economy around coffee.

“We have a very good local demand that should be matched with a local supply,” says Ibrahim. “We have the climate and resources, so why not?”

Saudi Arabia is playing the long game

Positioning itself as a coffee-producing region is part of a wider strategy where Saudi Arabia is undergoing various social and economic reforms. As a part of this, there are massive investments going towards developing many new sectors.

For example, there are approximately 15 “giga projects” in various stages of development, focused on tourism and hospitality. The aim is to boost annual tourism numbers from about 25 million today to 100 million by 2030.

Essentially, the country is establishing itself as a trade hub for the Middle East and, ultimately, opening itself up to the world.

“It’s all under the umbrella of Saudi Arabia’s Vision 2030,” says Ibrahim. “The government named 2022 the year of Saudi coffee. This national campaign is about increasing yield and quality of production.”

The country seems set up for success – with high consumption, a centuries-long history in coffee production with favourable growing conditions next to Yemen’s mountainous terrain.

Despite this, retaining farmers in the agricultural sector has been a challenge, with more profitable industries like oil and gas providing stiff competition. “The coffee farms in the south were mostly abandoned until now,” says Ibrahim.

“Currently, there are 2,500 farms in the southern region with an 800-tonne production, which is negligible if you compare with Burundi, Rwanda or the Democratic Republic of the Congo – which average anywhere between 15,000 and 23,000 annual tonnes.”

Therefore, although Saudi may be able to produce enough coffee to satisfy internal demand, it could be considered an overstatement to claim the country can compete on the global stage with these production volumes.

However, some have faith in the process; confident in the knowledge that investment in coffee production, and agriculture generally, takes time to bear fruit.

“It’s just a matter of time to make the coffee production sector come to life again,” says Ibrahim. “Although progress may be slow, I’m confident that in the next five years or so, we’ll be seeing results.”

The success of this coffee campaign, and the broader tourism and hospitality strategy, may ultimately depend on how international players respond to doing business with Saudi Arabia. For a long time, many have been cautious about this. However, according to some, this is an old trope.

“People are very friendly, especially with foreigners,” says Ahmed Kojok, Q Grader, AST and roaster based in Saudi Arabia. “Now, the main green coffee suppliers are establishing operations here, and we’re also seeing big international companies like Starbucks and Illy with Saudi headquarters – there’s a lot of foreign investment and the government is encouraging this.”

It’s certainly an exciting time for Saudi Arabia. It remains to be seen whether its bid to meet domestic coffee demand with its own supply and, beyond that, position itself competitively on the global market will be successful.

However, with such an incredible amount of resources being channelled towards the country’s coffee industry, and considering the amount of change that has happened in just the last five years – the next five are certain to be very interesting to witness.